Bank Of Canada Cbdc Paper

The paper writer also shed more light on another reason why higher flexibility of monetary policy can be reached by introducing a CBDC. Thats the thread running through a new staff analytical note issued by the Bank of Canada today examining the security risks for a hypothetical token-based CBDC.

Central Bank Says Cbdc Probably Necessary For Competition In Canada Thenewscrypto

Overall competitive and innovative advantages are supporting arguments for issuing a CBDC.

Bank of canada cbdc paper. A CBDC could also support the vibrancy of the digital economy. The changes in money and payments described here also have an effect on wholesale payments which are larger payments between financial institutions and business. Each of the papers provides a thought-provoking perspective on the potential design of a CBDC in Canada providing a mix of engineering economic financial market and legal analyses and proposals.

Many have described the Federal Reserve as a cartel a gang that is engaged in unethical actions against the citizenry. Users of cash do not. The Bank has a history of making bank notes that are accessible.

Designing a CBDC for universal access. A growing number of people have become quite critical of the current central banking system. As mentioned in the first paper of the CBDC series the Bank of Canada has defined drivers that would cause them to issue a CBDC.

The Bank of Canada BoC has addressed arguments for a central bank digital currency CBDC in a discussion paper. The Bank of Canada European Central Bank Bank of Japan Sveriges Riksbank Swiss National Bank Bank of England Board of Governors of the Federal Reserve and Bank for International Settlements have collaborated on a report setting out common foundational principles and core features of a CBDC. In its discussion paper the BoC said that a CBDC could be an effective competition policy tool for payments.

Yesterday the Bank of Canada published a report discussing the key motivations for a central bank digital currency CBDC. White Paper prepared by Payments Canada the Bank of Canada TMX Group Accenture and R3 This report describes the findings of the third phase of Project Jasper a collaborative research initiative between the public and private sectors to understand how distributed ledger technology could transform the future of payments and securities. It argues that a CBDC is probably necessary to support the development of the digital economy.

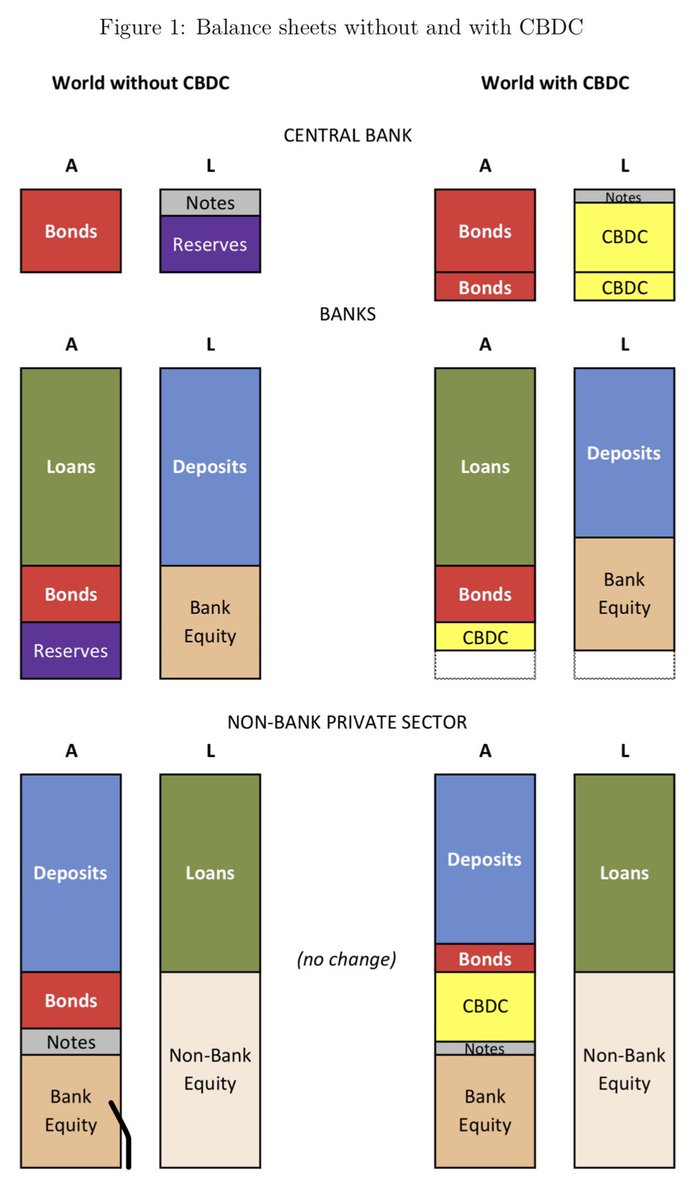

Universal access is a Bank of Canada policy and design goal. 1 They are available in Canadas urban rural and remote communities. Addressing concerns that a CBDC could compete with bank deposits spur bank runs and compromise individual security the paper highlighted central banks very cautious approach The paper said that CBDCs qualified as money by allowing store of value and being a unit of account and means of exchange differentiating them from cryptocurrencies that do not meet these criteria.

The authors identified two primary triggers for issuing a CBDC the first being a declining use of cash. If CBDC and bank deposits were close substitutes then a CBDC with a non-zero interest rate could provide a floor for deposit rates. Bank of Canada Staff Working Paper No.

The paper will include details of what a US. The Bank of Canada paper argues that CBDCs endowed with programmability through smart contracts will engender vibrant innovation and competition in. We quantify the welfare gains of a CBDC that come from its interest-bearing feature and show that they can be sizable.

This flexibility can help central banks implement monetary policy more effectively and achieve higher welfare. The report Central bank digital currencies. The papers were published on the Banks website in February 2021.

This paper describes the Bank of Canadas decision to create the capabilities needed to issue a cash-like retail CBDC. A CBDC would give consumers a non-bank. A central bank digital currency is probably necessary for a competitive digital economy the Bank of Canada said in a staff paper published Tuesday.

With the new form of money the central bank can monitor agents portfolios of CBDC and can cross-subsidize between different types of agents This feat that will not be possible if the country is using only fiat currency. Payments Canada has published Central Bank Digital Currency CBDC. Foundational principles and core features was compiled by the Bank of Canada the Bank of England the Bank of Japan the European Central Bank the Federal Reserve Sveriges Riksbank the Swiss National Bank and the BIS and highlights three key principles for a CBDC.

Canadas central bank seems much eager toward adoption of blockchain technology. Bank of Canada staff analytical notes are short articles that focus on topical issues relevant to the current economic and financial context produced. In a staff paper published Tuesday the Bank of Canada has laid out a positive case for CBDC adoption.

It could help solve market failures and foster competition and innovation in new digital payments markets. The paper written by University of Illinois professor Charles Khan and Bank of Canada staffer Francisco Rivadeneyra claims that The safety of CBDC willdepend on the competition between providers of aggregation solutions. Canada Explores CBDC Benefits.

The Bank of Canada Expects To Boom With CBDC. The emergence of an alternative currency such as Diem previously known as Libra that5 could undermine the Canadian dollar as a. CBDC might look like.

The fundamentals paper explores the motivations for CBDC issuance in Canada and outlines the differences between CBDC cryptocurrency and conventional bank notes as well as discusses emerging CBDC use cases. The Fundamentals the first in a series of educational papers on CBDC. Competition and Innovation Favor CBDCs Says Bank of Canada.

We discuss the competition and innovation arguments for issuing a central bank digital currency CBDC. A CBDC could be an effective competition policy tool for payments. For example for Canada the gains from introducing a CBDC are estimated to be an increase in consumption of around.

These principles emphasise that in order for. Canadas central bank appears to be bullish on CBDCs. Coexistence with cash and other types of money in a flexible and innovative.

The central bank of Canada released their draft paper about the adoption of Central Bank Digital Currency and explained their many beneficial facts to use. Increased competition amongst payment service providers and digital innovation. The authors of the paper outline several potential benefits such as promoting competition in the financial sector and improving consumer choice.

The paper detailed the primary benefits of developing a Canadian digital dollar. It argues that a CBDC is probably necessary to support the development of the digital economy.

Bis 7 Central Banks Share Findings On Retail Cbdcs Needs To Be Sexy Ledger Insights Enterprise Blockchain

Central Bank Digital Currencies And The Digital Euro Cash Infra Pro

Overview Of Central Bank Digital Currency State Of Play Suerf Policy Notes Suerf The European Money And Finance Forum

Bank Of England States Central Bank Issued Digital Currency Will Compete With Commercial Banks Rich List Best Loans Short Term Loans

Ga Cbdc System Generic Framework Download Scientific Diagram

Pdf Retail Central Bank Digital Currency Design Considerations Rationales And Implications Semantic Scholar

Gilbert Verdian On Twitter Report From The Central Bank Of Lithuania Lietuvosbankas See Cbdcs 1 As A Means For Safe Trustworthy And Cost Efficient Instrument 2 As A Way To Address Payments Shortage

Pandemic Accelerates Bank Of Canada S Cbdc Work

Bank Of England Executive Supports Calls For Cbdc Issuance Btcmanager Bank Of England Digital Currency Silver Investing

Pdf A Survey Of Research On Retail Central Bank Digital Currency Semantic Scholar

Gilbert Verdian On Twitter Federalreserve Preconditions For A General Purpose Central Bank Digital Currency Cbdc Must Be Supported By Robust Technology That Ensures Its Safety And Efficiency Lastly Market Readiness Is Needed For

Main Elements Of The Paper Download Scientific Diagram

List Of Banks In Lebanon With Their Official Information In 2021 Financial Organization Lebanon Central Bank

Central Bank Of Canada May Launch Its National Digital Currency Cbdc